Introduction:

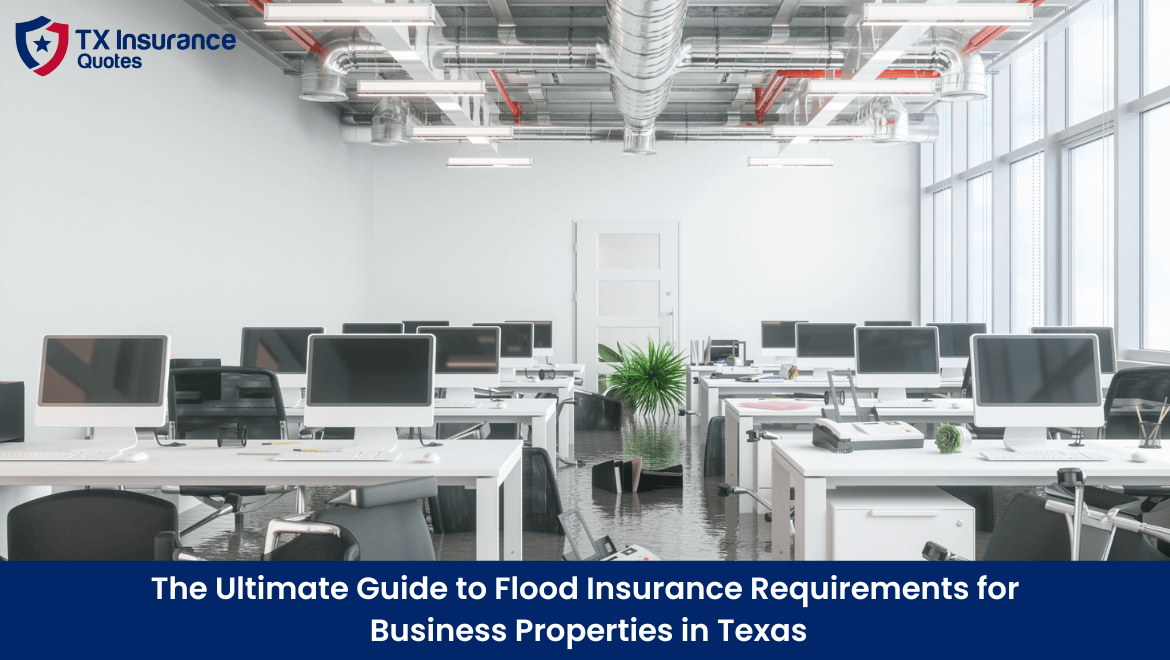

With all the expenses of owning and running a business in Texas, you may skimp certain insurance coverage to save money. However, if your business is located in a high-risk flood zone, not having flood insurance could be costly.

Considering that floods are the most common natural disaster in the United States, and just a few inches of water can cost thousands of dollars in damages, it’s important to understand the flood insurance requirements for your commercial property.

How to Determine if Your Commercial Property Needs Flood Insurance:

A flood is generally defined as a temporary condition of partial or complete inundation of normally dry land areas from:

- The overflow of inland or tidal waters.

- The unusual and rapid accumulation or runoff of surface waters from any source.

- A mudflow is a type of landslide that can bring large amounts of water, rock, and debris down a slope during heavy rains.

- collapse or subsidence of land along the shore of a lake or a similar body of water as a result of erosion or flooding

- the current of water exceeding its banks because of heavy or prolonged rainfall

You should consider getting commercial flood insurance in Texas if:

- Your business is situated close to a body of water that could overflow and cause flooding (even if you’re not in an official high-risk flood zone)

- You operate in a zone that has cold winters and spring thaws (which can cause flash flooding)

- Your business is in an area that’s prone to heavy rains.

- You have a history of flooding on your property.

Moreover, a lot of business owners assume that their business property is automatically covered against floods because it’s included in their general commercial liability policy. However, this is not the case. Most commercial property insurance policies exclude flood damage, so you’ll need to purchase a separate flood insurance policy if you want to be covered.

What Does Commercial Flood Insurance Cover?

Broadly there are two types of commercial flood insurance policies available to business owners in Corpus Christi:

Content Insurance:

This type of insurance covers any physical damage to your commercial property and its contents caused by a flood. This includes:

- Office equipment

- Furniture

- Inventory

- And any other business-related items that are stored on your premises

Building Insurance:

If you own the commercial building that your business operates out of, this type of insurance will cover damages to the physical structure of the building itself. This includes:

- Foundation

- Walls

- Floors

- Stairways

- Electrical and plumbing systems

- Elevators

- Central air conditioning units

- Any permanently installed carpeting or paneling

Both of these types of policies cover up to $500,000 in damages (per occurrence). However, evaluate the value of your property and contents to ensure this is enough coverage for your needs. You can also purchase excess flood insurance if you need additional protection.

Benefits of Having Commercial Flood Insurance:

Although flood insurance isn’t required by law in Texas, it has several benefits, especially if your business is located in a high-risk flood zone. Let us discuss two of the main advantages:

Protection Against Financial Loss:

One of the main advantages of carrying commercial flood insurance is that it provides security against the financial losses resulting from flooding. Paying for the repairs and replacements out of your pocket could seriously damage your business, but with insurance, you can rest assured knowing that you won’t have to bear the entire burden yourself.

Help To Get Back on Your Feet Quickly:

Another benefit of commercial flood insurance is that it can help you quickly get your business up and running after a flood. This is because the insurance will cover the costs of repairs and replacements, so you won’t have to worry about coming up with the money yourself. In addition, some policies also cover the costs of lost business income, which can help tide you over until your business is up and running again.

How Much Does Commercial Flood Insurance Cost?

The premiums for commercial flood insurance policies in Brownsville are based on several factors, including:

- Your property age

- Occupancy and location

- The value of your property and contents

- The amount of coverage you need

- Flood risk in your area

- The deductibles you choose

However, on average, policies start at around $500 per year and take about 30 days to go into effect.

Get a Commercial Flood Insurance Quote From Us

If you’re interested in purchasing commercial flood insurance for your business in El Paso, TX Insurance Quotes can help. We are an independent insurance agency that offers flood insurance from various carriers. This means we can find the best policy for your needs and budget. Call us today to get started!

Related Read: Windstorm Insurance: What is it and how it works.